The Best Money Saving Tips for Singles

Mar 15, 2024 By Triston Martin

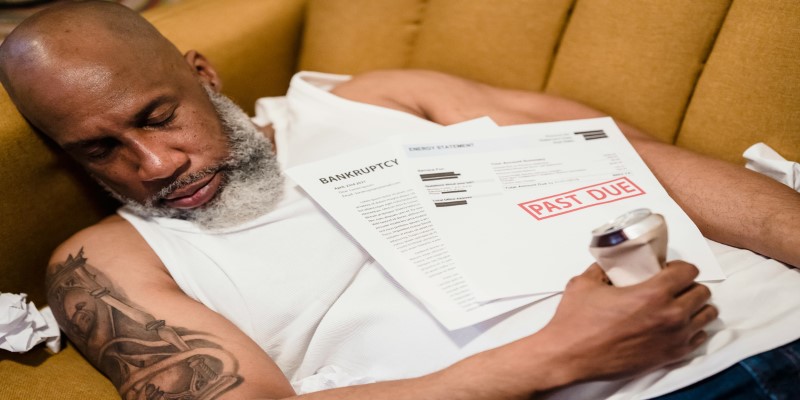

As a single person, you do not have the responsibilities of family or a spouse on your shoulders. Hence, as soon as you get your paycheck every month, your expenditure mentality probably changes to you only live once, and you go on about spending your money enjoying your life to the fullest. However, it is halfway through the month when the after-maths of your expenditure start showing up, right?

It is only then that you realize that you should have controlled your you only live once mentality a bit and should have thought about saving some amount. If this is the case with you every month and now you have made it your aim to save some money, then let us help you out with it. Hop on below to learn some of the best money-saving tips for singles, which will help you bring your accounts on the right track.

The Top Money Saving Tips All Singles Should Know

Forming a financial safety net in the form of savings that you can use in emergencies is essential. If you cannot save money to save money, you might be hopping on the web to learn some tips on saving money. Lucky for you, we have some of the best money saving tips listed below for you:

Keep a Check on Your Expenses

The first and most crucial tip when saving money is to check your monthly expenses. It is important to have a clear understanding of your major expenses for each month, where your money would flow the most, and what financial expenditures of your life you cannot deny. With the major aspects out of the way, the next step would be to consider all minor or unforeseen expenses that may arise.

Keep Unnecessary Expenses to a Minimum

While spending your amount on major and minor expenses is something you have to do at all costs, another aspect you would want to spend money on would be your wishes as well. These wishes would include spending on things that would make you happy or something youd meant to do for a while. However, while spending on your wishes or discretionary is important and makes making money feel worth it, it is also essential to keep all other unnecessary expenses apart from it at a minimum.

Stick to Your Budget

With all your expenses and discretionary spending sought out, it is now time to budget your salary according to it. Having a budget will allow you to reach your financial goals easily. The best approach to budgeting is the 50-30-20 rule.

You can set 50% of your monthly income for your essential expenditures and necessities, 30% of it you can set aside as your discretionary spending, and the remaining 20% can be set aside as your long-term objectives or savings.

Take Up Life Insurance Plans

Getting life insurance is also a great way to ensure financial stability and safety in case you have a family dependent on you in the future. Insurance planning can help fulfill future demands like marriage, childrens school fees, and many other aspects in the long run. Hence, if you believe that it might come in handy in the near future, signing up for one now can be a game-changer.

Look into Investment Options

While saving a particular amount from your income is a smart idea, putting a small amount into some sort of investment is an even better one. Investments are a great way to grow your wealth, and there are several ways to invest your money, such as endowment plans and ULIPs.

Stay Away from Debt

If you are in debt, you might have a hard time-saving money. Hence, it is essential to get out of debt first in order to achieve financial independence. Being debt-free would help you breathe a sigh of relief and enable you to avoid wasting your money on high-interest credit card payments. Moreover, developing a debt payment strategy would help you assist in developing a plan and motivate you to become debt-free.

Increase your Assets Reduce Your Liabilities

If there is one thing we all know, your salary has remained quite where it was while the expenses around you have massively increased. This is the hard reality of life where the payment you receive from your employer does not rise every day. However, the utility expenses around you would keep on spiking. Hence, knowing how much you pay for each utility is essential. Keep an eye on those, and then continue to save money by eliminating superfluous utilities that can be avoided.

Stay on Top of Your Taxes

If there is one thing no one likes to dowell, unless you are an accountantit is taxing, of course. Not only is keeping track of your taxes time-consuming, but for many, it can be a daunting task, too. However, it is something on your savings journey that needs to be done on time.

When you pay your taxes on time and stay on top of them, you will gain a clear idea of the amount you can save. Hence, when trying to save your money, ensure you are also on top of your taxes.

Wrapping Up!

While spending money on your needs and wants is essential, saving some of your income is also crucial to securing a future for yourself. This is because no one knows what the future might bring; hence, having emergency financial aid to fall back on in times of crisis is always a smart approach. If you are a single person having difficulty saving money, we hope our money-saving tips are essential for you. Moreover, if you have any more tips to recommend, feel free to do so.

-

Mortgages Oct 17, 2023

Mortgages Oct 17, 2023Choosing the Best Mortgage Lender: CitiMortgage or Chase Bank Mortgage?

Are you torn between CitiMortgage and Chase Bank for your mortgage? Give this article a read to discover the best fit for your needs.

-

Taxes Mar 16, 2024

Taxes Mar 16, 2024What are Green Tax and ESG Tax Credits: What Accountants Need to Know

Let’s understand the world of Green Tax and ESG Tax Credits with our simple guide. Discover how these incentives drive sustainability and environmental responsibility.

-

Mortgages Feb 08, 2024

Mortgages Feb 08, 2024Best Private Business Loans

Need financing to support and grow your small business? Compare rates, terms, and requirements from different private lenders to find the best loan for you.

-

Banking Dec 29, 2023

Banking Dec 29, 2023No Balance Transfer Fee Credit Cards

There are credit cards available that do not charge a fee to transfer a balance, but your selections may be restricted. If you save money in the long term, it may be well worth paying the charge in many situations.